Overnight Gaps in DAX

The DAX futures market is only open from 8:00 until 22:00 (Frankfurt time) which means we generally see gaps in the market when it reopens in the morning. This exposes traders holding positions overnight to additional risk.

In theory one might expect this risk to be rewarded with a risk premium, but as we'll see that is not the case.

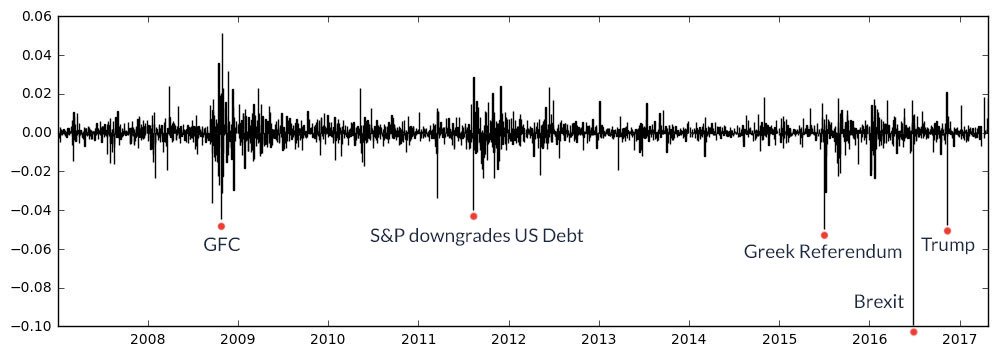

Here's an overview of all the gaps over the last 10 years:

| Gap up | Gap down | Total | |

|---|---|---|---|

| Count: | 1377 | 1222 | 3599 |

| Average Gap: | 0.34% | -0.37% | 0% |

| Standard Deviation: | 0.4% | 0.55% | 0.59% |

| Biggest Gap: | 5.14% | -9.94% | -9.94 |

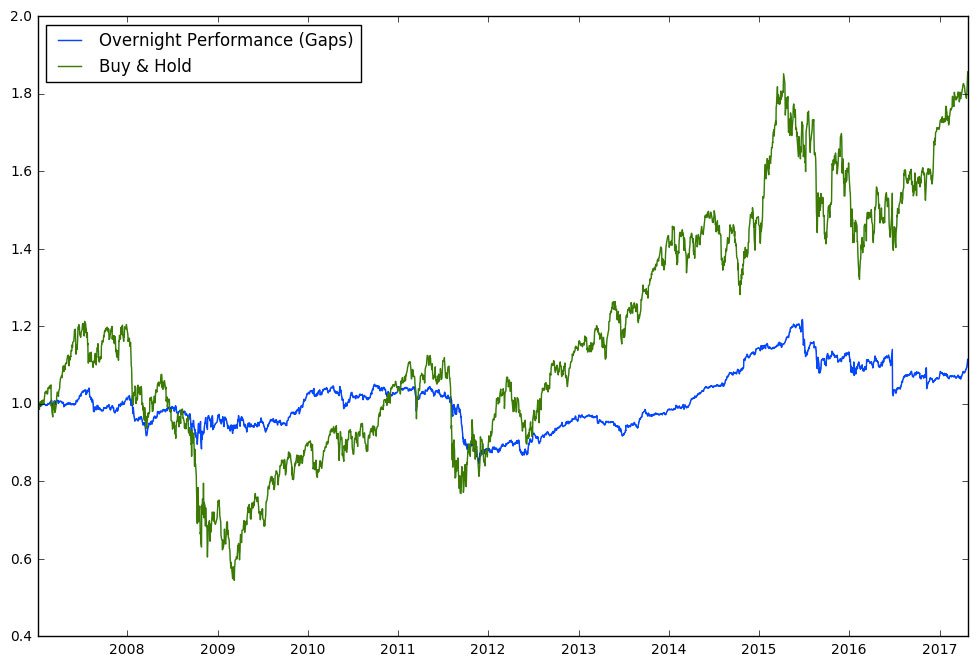

The total average gap is 0% which means that there's no overnight risk premium. This can be seen in the chart below.

When we look at all the gaps plotted over time we can see that there have been far more outliers to the downside than to the upside.

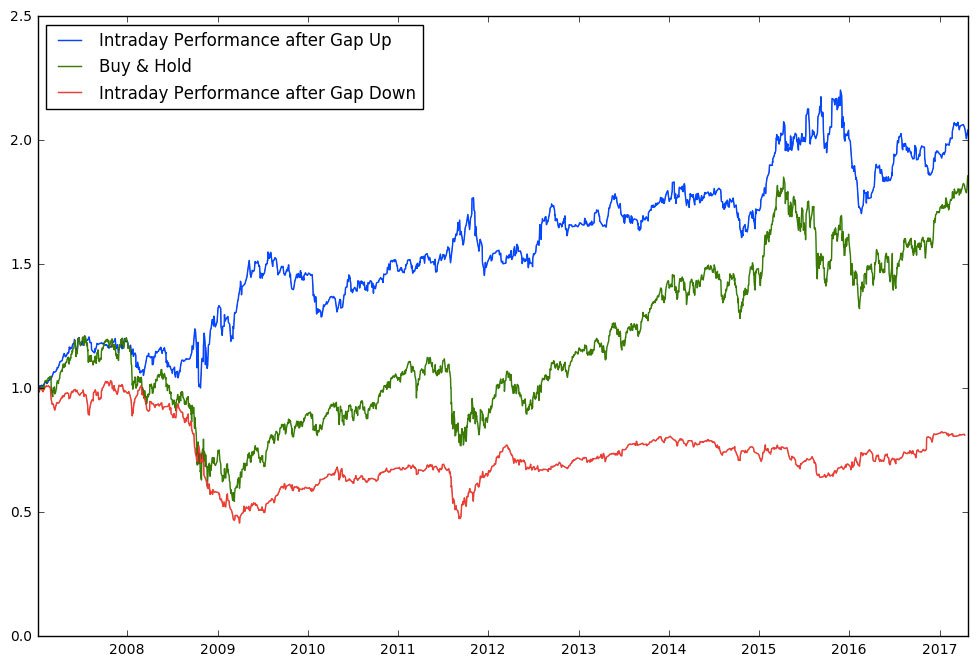

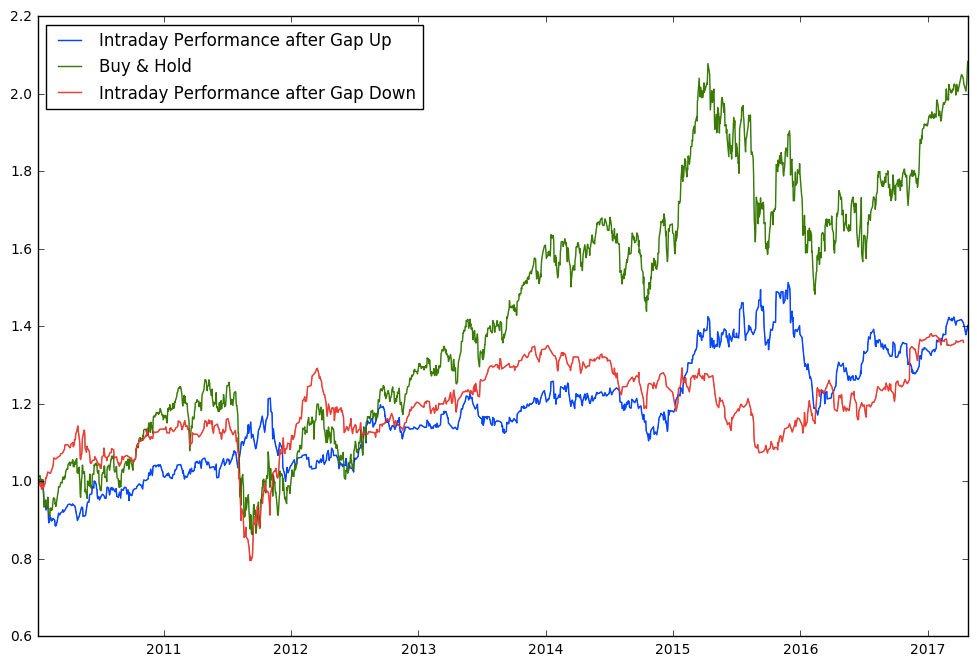

Does the market continue falling when it gaps down? Does it keep on rising after a gap up? The chart below shows the cumulative intraday performance following a gap up/down, no transaction costs were deducted (although these would have a great impact on the performance).

At the first glance it looks like the intraday returns following a gap up are outperforming the buy & hold strategy. That's because they indeed did in the period of 2007 - 2009. But if we look at the returns from 2010 onwards we can see that in the recent years there has been no edge in following gap directions.